The Facts About Nj Cash Buyers Uncovered

The Facts About Nj Cash Buyers Uncovered

Blog Article

Facts About Nj Cash Buyers Uncovered

Table of ContentsIndicators on Nj Cash Buyers You Should KnowNot known Details About Nj Cash Buyers Examine This Report on Nj Cash BuyersAbout Nj Cash Buyers

Many states provide customers a certain degree of security from financial institutions concerning their home. Some states, such as Florida, entirely exempt the house from the reach of specific creditors. Various other states set limitations varying from as low as $5,000 to up to $550,000. "That implies, despite the value of your house, financial institutions can not require its sale to satisfy their cases," says Semrad.If your home, for instance, deserves $500,000 and the home's mortgage is $400,000, your homestead exemption can stop the forced sale of your home in order to pay creditors the $100,000 of equity in your home, as long as your state's homestead exception is at least $100,000. If your state's exemption is much less than $100,000, a insolvency trustee can still require the sale of your home to pay lenders with the home's equity in extra of the exemption. You can still go into repossession via a tax obligation lien. If you stop working to pay your residential or commercial property, state, or government taxes, you can lose your home with a tax obligation lien. Getting a house is a lot easier with money. You don't have to wait on an examination, evaluation, or underwriting.

(https://stocktwits.com/njcashbuyers1)I know that many sellers are much more most likely to approve a deal of money, however the seller will certainly get the money regardless of whether it is financed or all-cash.

Things about Nj Cash Buyers

Today, concerning 30% of US homebuyers pay cash money for their homes. That's still in the minority. There may be some great factors not to pay money. If you just have adequate cash to pay for a home, you may not have actually any left over for repair services or emergencies. If you have the money, it may be an excellent idea to establish it aside so that you have at the very least three months of real estate and living expenses must something unexpected occur was shedding a task or having clinical issues.

You might have credentials for a superb mortgage. According to a current study by Cash magazine, Generation X and millennials are taken into consideration to be populaces with one of the most possible for development as borrowers. Taking on a little bit of debt, specifically for tax objectives terrific terms might be a much better alternative for your finances overall.

Maybe purchasing the supply market, common funds or a personal company could be a much better choice for you over time. By buying a residential property with cash, you risk depleting your get funds, leaving you vulnerable to unanticipated upkeep costs. Having a building entails continuous prices, and without a home loan padding, unexpected repairs or renovations could stress your finances and impede your capability to preserve the building's condition.

Getting My Nj Cash Buyers To Work

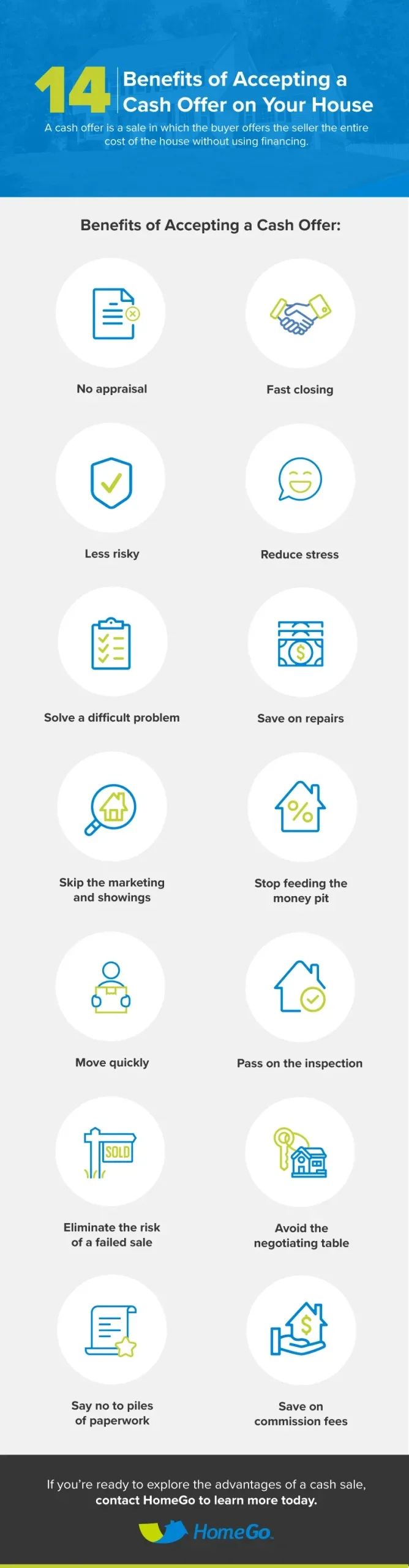

Home prices climb and fall with the economic climate so unless you're intending on hanging onto your home for 10 to thirty years, you could be much better off spending that cash in other places. Getting a residential or commercial property with cash money can expedite the buying procedure significantly. Without the need for a home mortgage authorization and linked paperwork, the deal can close faster, providing an affordable edge in competitive genuine estate markets where vendors may prefer money buyers.

This can result in significant price financial savings over the lengthy term, as you will not be paying rate of interest on the car loan amount. Cash purchasers frequently have stronger negotiation power when managing sellers. A cash deal is more appealing to vendors since it decreases the danger of a bargain dropping through because of mortgage-related problems.

Bear in mind, there is no one-size-fits-all remedy; it's important to tailor your choice based upon your specific circumstances and long-term aspirations. All set to start looking at homes? Offer me a call anytime.

Whether you're selling off properties for a financial investment residential property or are faithfully conserving to buy your desire home, purchasing a home in all cash money can dramatically increase your purchasing power. It's a calculated move that reinforces your placement as a purchaser and improves your adaptability in the actual estate market. It can place you in an economically at risk area.

The 45-Second Trick For Nj Cash Buyers

Reducing passion is just one of one of the most typical factors to get a home in cash. Throughout a 30-year mortgage, you can pay tens of thousands or perhaps hundreds of countless bucks in overall rate of interest. In addition, your buying power increases with no financing backups, you can check out a broader option of homes.

Property is one financial investment that has a tendency to surpass inflation over time. Unlike supplies and bonds, it's considered less risky and can offer short- and lasting wide range gain. One caveat to note is that during certain economic markets, real estate can produce much less ROI than various other investment key ins the short-term.

The biggest risk of paying cash money for a home is that it can make your funds unstable. Binding your liquid properties in a residential property can minimize economic adaptability and make it extra challenging to cover unanticipated expenditures. In addition, linking up your cash money indicates missing out on high-earning financial investment possibilities that could generate greater returns in other places.

Report this page